owe state taxes california

You received a letter. Depending on what you sell you may owe excise tax.

You Owe Taxes In California What Happens Landmark Tax Group

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

. The California Revenue and Taxation Code RTC provides authority for the FTB to take involuntary collection actions. Visit a Western Union location near you to make your. If you had money.

An IA allows a CA taxpayer to pay the FTB over a series of monthly payments until the delinquent tax. Top 250 who owe taxes to California FTB. What you may owe.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you make 70000 a year living in the region of California USA you will be taxed 15111. From the original due date of your tax return.

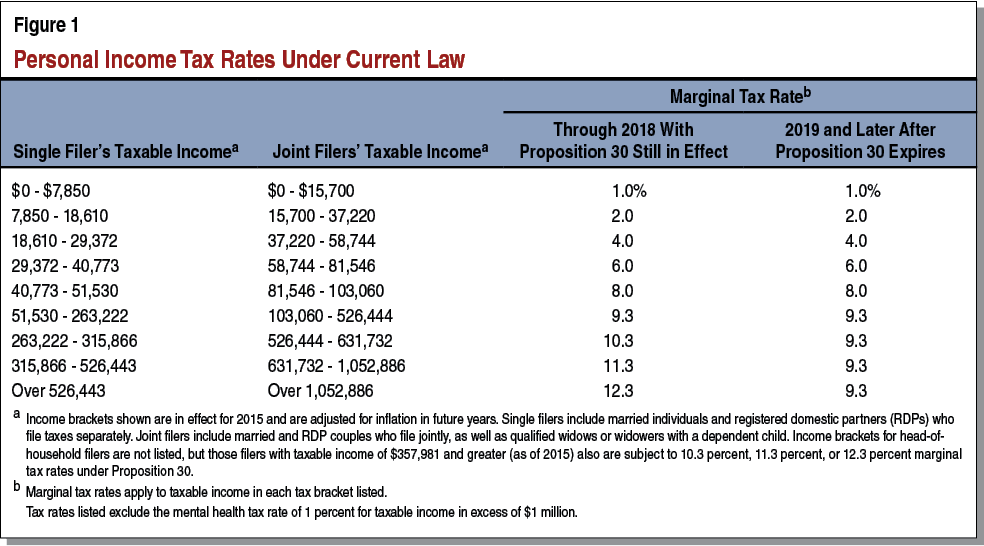

California Franchise Tax Board Certification date. Like with federal income tax brackets California uses a graduated-rate income tax system. Complete the form and mail it to.

Californias FTB offers an Installment Agreement IA also known as a payment plan. You filed tax return. California Use Tax Information.

Once a Notice of State Tax Lien is recorded or filed against you the lien. Generally you must make estimated tax payments if in 2022 you expect to owe at least. A lien secures our interest in your property when you dont pay your tax debt.

California Income Tax Calculator 2021. According to the FTB there are. Filing Season Tax Tips January 5 2022 Franchise Tax Board Hero Receives States Highest Honor for Public Servants December 24 2021 October 15 Tax Deadline Approaching to File and Claim the Golden State Stimulus October 8 2021 Assembly Bill AB 5 - Employment Status.

Why do I owe California state taxes this year. EFT Unit PO Box 942857 Sacramento CA 94257-0501. After applying any payments and credits made on or before the original due date of your tax return for each month or part of a month unpaid.

For more information about Use Tax please visit. Avoiding State of California Franchise Tax Board Enforcement Action. And you expect your withholding and credits to be less.

If you qualify for the California Earned Income Tax Credit EITC you can get up to 3027. Your household income location filing status and number of personal exemptions. Why We Pay State Taxes People who have earnings and enough connection to.

For example if youre in the 8. This table can only be used to report use tax on your 2021 California Income Tax Return. California Franchise Tax Board lists names of individuals and businesses that owe taxes to the state.

If you do not owe taxes or have to file you may be able to get a refund. As of July 1 2021 the internet website of. Franchise Tax Board Attn.

250 if marriedRDP filing separately. Your average tax rate is 1198 and your marginal.

California State Tax H R Block

I Owe California Ca State Taxes And Can T Pay What Do I Do

Working From Home You Might Owe Income Tax To Two States Cnn Politics

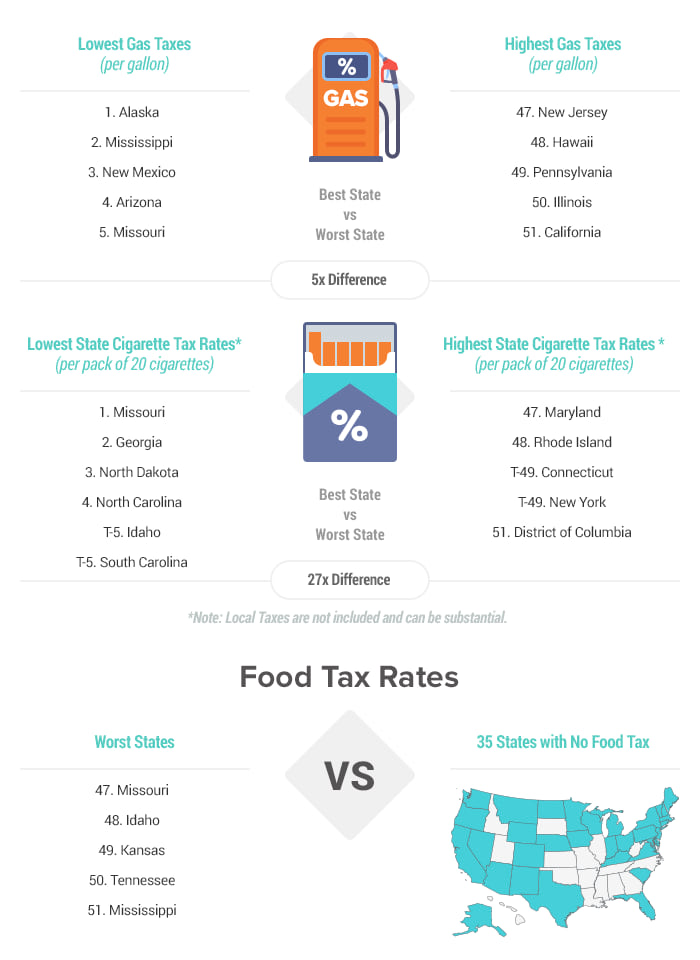

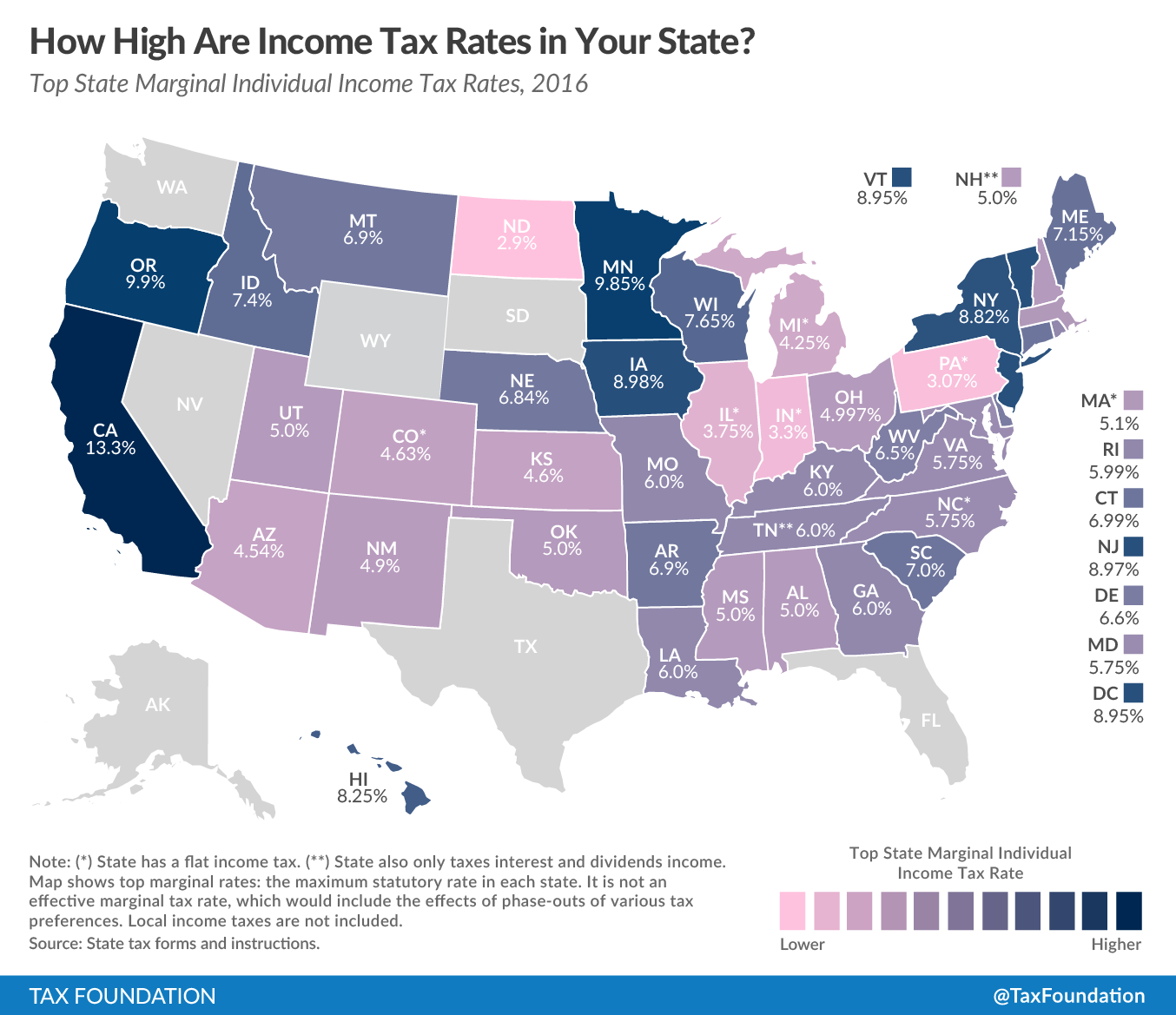

States With The Highest Lowest Tax Rates

California De 4 Form How To Fill Out In 2021 Youtube

Caleitc And Young Child Tax Credit Official Website Assemblymember Wendy Carrillo Representing The 51st California Assembly District

California Tax Calculator Taxes 2022 Nerd Counter

California Back Taxes Resolutions Overview Ftb

All Freelancers With Clients In California Now Owe State Taxes There No Matter Where You Live R Freelance

California Taxpayers Association California Tax Facts

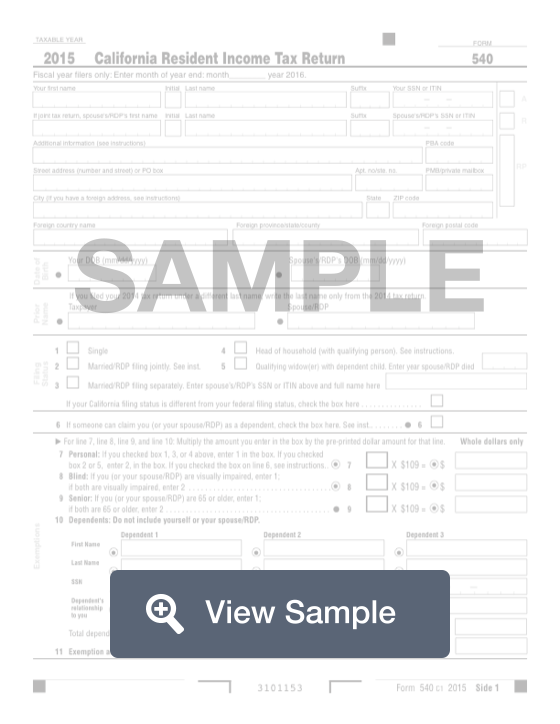

Irs Form 540 California Resident Income Tax Return

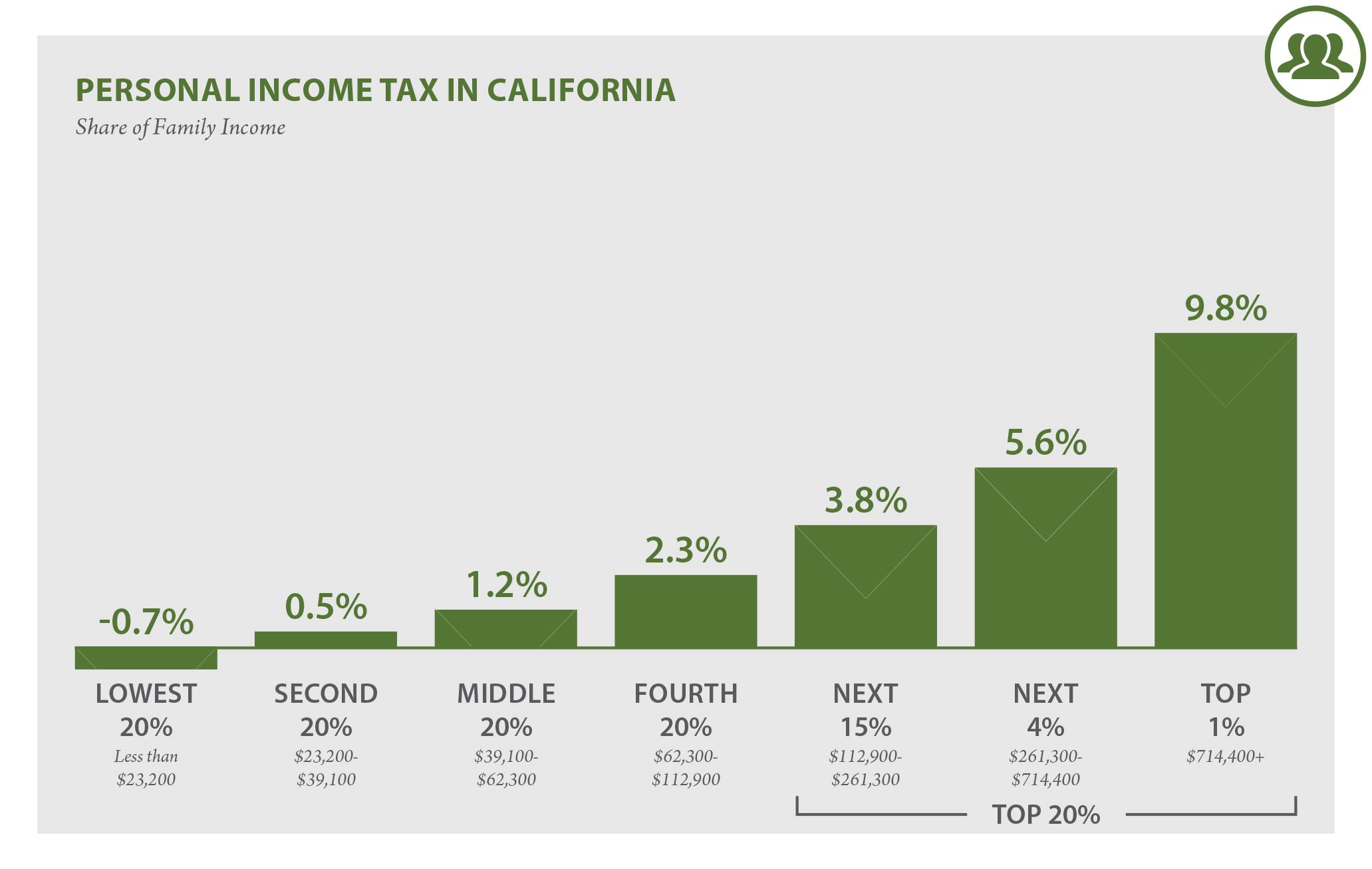

California Who Pays 6th Edition Itep

California Franchise Tax Board Ftb Help Landmark Tax Group

Printable Ca Form 540 Resident Income Tax Return Pdf Formswift

Why Some Out Of State Residents Could Be Surprised To Learn They Could Owe Large Sums Of California Income Taxes To The Franchise Tax Board Ftb

Personal Income Taxes And Funding For Education And Health Programs Amendment No 1 Ballot

California Prop 55 Extending Higher State Income Taxes For Education And Health Tax Foundation